Helping members who have just joined the Scheme

Your membership

You will normally become a member of the Scheme automatically on day one of joining the UK HSBC Group. The Bank automatically pays into your Defined Contribution (DC) pension pot in the Scheme each month, even if you do nothing. It pays in 10% of your first £28,100 of pensionable salary then 9% of anything over £28,100 up to the Scheme Earnings Cap (currently £191,000). You can also choose to make your own contributions and you could benefit from matching contributions from the Bank. It will match anything you pay up to 7% of your pensionable salary (up to the scheme earnings cap).Your membership of the Scheme is a really valuable part of your HSBC benefit package. It’s worth understanding all your options in the Scheme so that you can make the most of this important benefit. A good place to start is this video for new joiners.After watching the video you’ll know more about the Scheme basics including:

-

How much it could cost you if you decide to pay into your DC pension pot each month

-

The tax savings you could make if you decide to pay into your DC pension pot

-

How your DC pension pot is invested

-

How the scheme is managed

-

Your options for taking your DC pension pot

-

Important actions you need to take and where to find the information you need

Personalise your DC pension pot

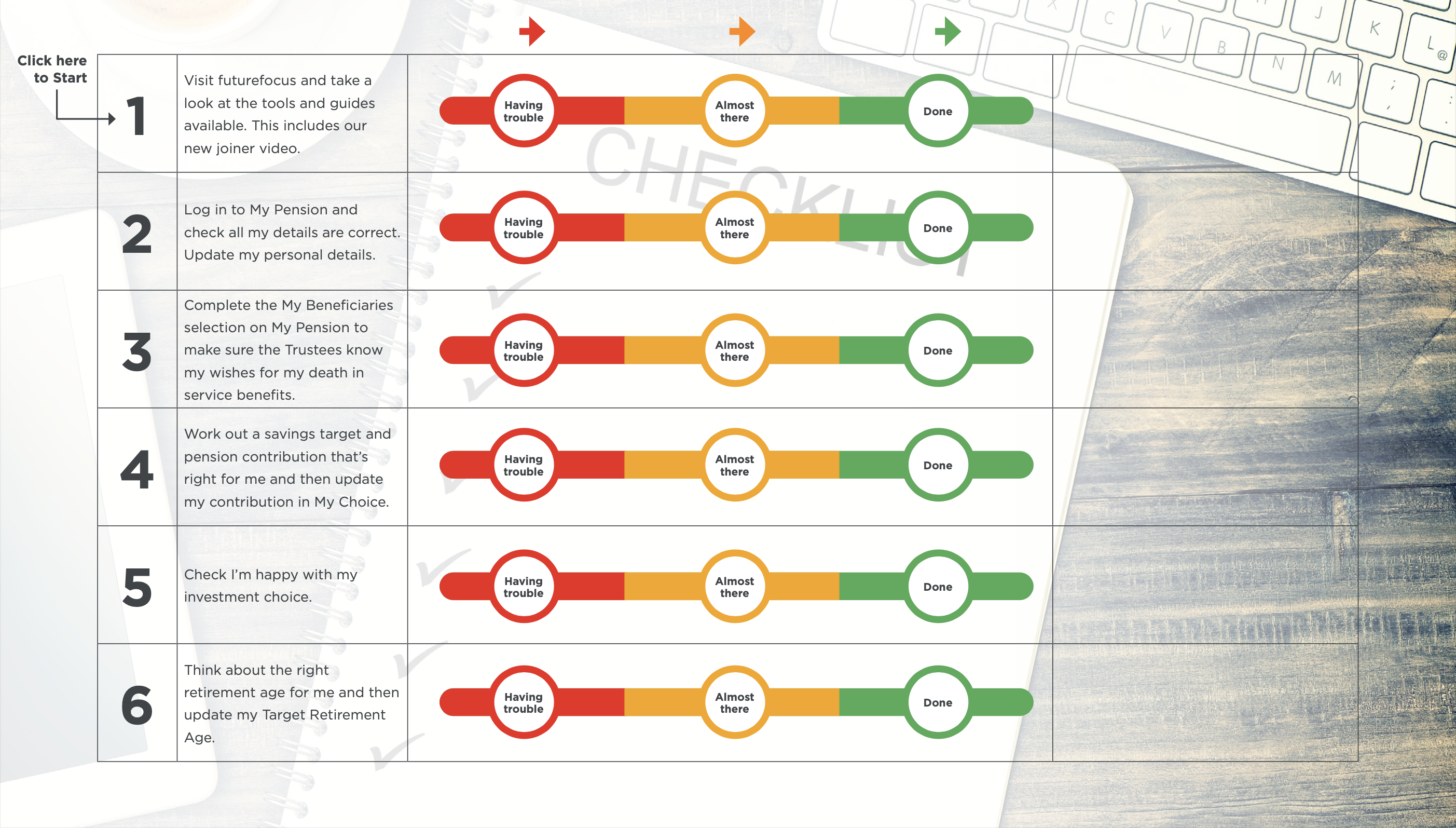

When you first joined the Scheme, we made some default selections for you to get you started. You can make your own choices at any time. Our new joiner checklist can help.

Click to launch

Pensions articles

Our pensions articles keep you informed about important pensions issues.

Solving the pension puzzle

What are the various types of UK pensions and why is it important to know the differences between them?

When you first start saving for your long-term future, it can be hard to get to grips with the basics of how pension schemes work and what you need to know. Our pensions myth busting podcast and regular member blogs can help.

Listen to our pensions myth busting podcast

Read our member blog

Five things I wish I'd known about saving when I was in my 20s

Top tips for new joiners

By logging into My Pension you can:

- See the current value of DC pension pot

- See your current investment choices and make an investment switch

- Check how your investments are performing

- Update your target retirement age

- Complete your expression of wish

My Pension is also where you will find the Pension Freedom Planner. This modelling tool can help you to set a savings target or check that your savings are on track. It provides instant answers to question like, “How much should I be saving into my DC pension pot” and “How much income could I take when I retire”?

The simple online tool on the futurefocus landing page is a quick and easy way to see how the Scheme’s contributions work. It shows you the value of the Bank’s core contribution as well as the matching contributions. Just put in your current salary and adjust the amount of your contribution to see how much you could be saving into your DC pension pot.

We have worked with a company called ‘WEALTH at work’ to develop a series of webcasts for our members who may be new to pension saving and the Scheme. These webcasts are designed to help you understand more about your DC pension pot.

After watching these webcasts, you’ll know more about:

- How DC pensions work

- How much you might need in retirement

- How you can boost your DC pension pot

- How your DC pension pot is invested and your investment choices

- The key actions you should take now

Learn more by viewing the webcasts.

We are also running online seminars to help explain the Scheme to our younger members and new joiners. To get involved, watch out for your email invite.

Our annual Scheme newsletter keeps you up to date on any changes or enhancements to the services and options available to members. It also tells you about any important changes to pension legislation that might affect how or when you can take your benefits. Find out about the latest changes and read the latest edition.

In 2021, the Trustee set an important Net Zero target for the Scheme’s investments.

The Trustee recognises the increased urgency with which climate change needs to be tackled and is playing an active role in supporting the drive to decarbonise the economy. It has been active in addressing climate issues for the Scheme’s investments for a number of years, including working in collaboration with regulators, policymakers, investment managers and other asset owners to facilitate the system-wide transition to a net zero economy.

Read more about the Trustees targets.

Login to My Pension

Check out your personal pension account where you can find the Pensions Freedom Planner and set your Target Retirement Age by logging into My Pension.

If you are on the HSBC network click here, if you are not on the HSBC network you will need your user name and password to log in.

Need a bit more information?

The "DC member guide" and the "New joiner guide" tell you all about your DC pension pot. You will find lots of information and explanation about your options and benefits including examples of savings targets and details of how pension tax works. If you have a question about your Scheme benefits, these guides are the first place you should check.