More about Drawdown Income

Understanding the basics

Watch the video to learn more about how Drawdown Income Works:

- Drawdown income gives you flexibility Take your Defined Contribution (DC) pension pot in a way that suits you. If you transfer your DC pension pot to a Drawdown income provider, you can withdraw as much or as little as you like, when you like as regular income or lump sums. And if you change your mind, you can use the money from your Drawdown pot to buy an annuity at any time.

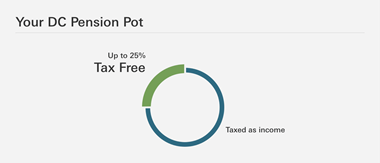

- Take up to 25% of your DC pension pot tax-free after you transfer to a Drawdown Income provider After you transfer your DC pension pot to a Drawdown income provider, you can normally take up to 25% tax-free up to the Lifetime Allowance. You can either take it all at once after you transfer or you can take 25% of each withdrawal that you make tax free. The balance will be subject to income tax.

- Be in control of your investments Your drawdown pot will be invested and you will need to choose investments that match your plans for the future. You will need to monitor the performance of your investments and your withdrawals to make sure you don’t run out of money sooner than you expect.

- Pass it onto your loved ones If there is some drawdown pot left over when you die, this can be passed onto your beneficiaries.

Things to think about when choosing your Drawdown Income provider

If you choose the Drawdown Income option, you will need to transfer your DC pension pot out of the Scheme to a Drawdown Income provider. Before you make any decision, it’s important to shop around and make sure you choose a provider that best matches your needs. There are many different providers available.

The Scheme Trustee has agreed competitive charges with LifeSight Spending, a drawdown income provider. As a member with a DC pension pot, we are pleased to let you know that you can access this service. You can find out more on the LifeSight Spending microsite, just click the link here.

Remember: If you want to take a flexible income, you have the option to transfer to LifeSight Spending or a different drawdown provider, it’s your choice. If you want to take your DC pension pot as drawdown income you will be transferring and exiting from the HSBC Bank (UK) Pension Scheme even if you choose to transfer to LifeSight Spending.

To help you to start comparing Drawdown Income providers we have put together this short checklist.

Drawdown Income gives you flexibility. You can change the amount and type of withdrawals that you make to suit your needs and changing financial circumstances. Here are some important points to know before opting for a Drawdown Income:

- You will need to keep track of your withdrawals

Drawdown income may not provide the same income certainty as an annuity. Whilst annuities provide a guaranteed income for as long as you live, a drawdown pot might run out if your investments don’t perform as you expect or you withdraw too much too quickly. Drawdown income may not provide a predictable, regular income in retirement.

- You will need to monitor your Drawdown pot investments

Your drawdown pot stays invested and this means that it can go up and down in value, so you will need to keep track of how your investments are performing. If your investments perform badly, you may need to consider withdrawing less income if you want your drawdown pot to last longer. Many providers will set up an online account and some have online tools to help you monitor your investments and show how long your pot will last, so that you can adjust your withdrawals if you need to.

Drawdown Income providers will offer a wide range of investment funds for you to choose between.

When you are choosing your investments for your Drawdown pot, you will need to think about how you plan to take your money from your drawdown pot over time. Some questions you may want to consider include:

- How long could you be taking an income from your drawdown pot? Will you be drawing an income from your drawdown pot straight away? If your drawdown pot needs to last for a long time, will you need to invest some of your drawdown pot in investment funds designed to provide long term growth?

- Will you need to regularly sell some of your investments to meet your income needs? Will you need to protect your drawdown pot against market falls?

- Will some of your drawdown pot be kept in cash so you can easily withdraw income over the short term?

Investment pathways

It’s worth considering how “hands-on” you want to be with managing your investments and how much knowledge and experience you have. You can create and manage your own portfolio from the range of investment fund options available from your provider. Alternatively, some providers offer you a choice from simple ready-made investment options which can be linked to your retirement plans (these are often called Investment Pathways).

An investment pathway simplifies the decision of how to invest your drawdown pot after you’ve taken your tax-free cash lump sum. The pathway is based on what plans you might have for your drawdown pot over the next five years. The pathway is managed by your provider, so you don’t need to worry about choosing your investment funds.

If you would like more information about choosing investments for your drawdown pot, a good place to start is MoneyHelper, a free government backed service. Visit Investing in Retirement on The MoneyHelper.

If you want to compare the charges for other Drawdown Income providers that offer a ready-made investment pathway option, you can take a look at the Money Helper tool on their website.

Understanding the charges that Drawdown Income providers will apply is really important. It can be difficult to compare charges because different providers charge different types of fees. These charges will typically be automatically deducted. It’s worth looking out for the following:

- A one-off charge to set up your drawdown account

- An annual administration charge

Some providers may charge a flat annual fee, others may charge a percentage of the amount you have in your drawdown pot. Some providers use a sliding scale where, for example, the first part of your drawdown pot has one fee (usually expressed as a percentage of your drawdown pot) with the next tranche incurring a lower charge and so on.

- Investment fund charges

These are often charged in addition to the administration fee and usually vary depending on the types of investment funds that you choose. Fees are generally expressed as a percentage of the amount invested. You may also incur other investment costs which arise when investments are bought and sold.

- An account closure charge

- A charge to transfer funds

It’s worth checking that you understand some of the key features of the different Drawdown Income products available in the market. These could include, for example whether:

- The provider requires you to transfer a minimum amount of DC pension pot into their Drawdown Income product.

- There are any restrictions on how often you can make withdrawals or limits on the maximum and minimum withdrawals you can make.

- The provider will give you access to an online account where you can monitor your investments and regularly check your remaining funds so that you can make adjustments to your spending if you need to.

- The provider will give you access to any planning tools to help you monitor your spending and check when your money could run out.

- You can take your tax-free cash in stages rather than taking it all upfront.

- Your provider will help you to review your drawdown pot each year to check whether your still on track or whether your drawdown pot could run out sooner than you expect.

Drawdown Income and tax

Your 'Personal Allowance’ is the income you can receive each year without paying tax. Any tax-free cash you take from your drawdown pot doesn’t count towards your Personal Allowance. Once you have taken your tax-free cash, any drawdown income that you take is taxed as income. It is added to any income you have from other sources in the tax year for calculating the rate and amount of tax to be paid.

If you decide to transfer some or all of your DC pension pot and start to take any income using Drawdown Income, you will trigger the Money Purchase Annual Allowance (MPAA). The MPAA limit for the tax year is £4,000 and, if triggered, any contributions that you or your employer make to your DC pension pot (or any other DC Scheme) that total more than £4,000 will be subject to a tax charge.

You can normally take up to 25% of your drawdown pot tax-free when you retire and after you transfer to your Drawdown income provider. After the transfer, you can take your tax-free cash all at once or you can take 25% of each withdrawal that you make tax-free.

It’s up to you what you do with your tax-free cash, but you may want to think carefully about how you take it. Don’t forget, inflation reduces the spending power of cash so you should think carefully before just leaving it in your current account for a long time.

What should I do next?

If you are thinking about taking your DC pension pot and would like to get a retirement quote or request a retirement pack, you can do this by logging-in to My Pension. Once logged in, select the Quotes drop down menu. Please note you can only request a retirement quote if you are aged 54 or over.

Alternatively, you can contact the Scheme administrators directly.

Additional help to make your choices

Have you attended a retirement seminar or watched a retirement webcast?

Our retirement seminars/webcasts are designed for active and deferred DC members aged 50 and over, to help you understand more about your retirement income options. Look out for your invitation from WEALTH at work. Click to watch the full series of Retirement webcasts for DC members over age 50.

Have you tried our Pension Freedom Planner?

If you want to find out more about how much income you could take using Drawdown Income, why not login to My Pension and use the modeller called the Pensions Freedom Planner.

Quick links to external help sources

Visit The MoneyHelper to find a financial adviser to help look at your personal financial circumstances and help you to understand which products could best to meet your particular needs. They can also help you to work out how much money you can withdraw from your drawdown pot based on how it might grow and how long it might need to last.

Visit Pension Wise and book an appointment to get more guidance before deciding whether Drawdown Income is right for you. Pension Wise is a free government backed service that offers impartial guidance for people with DC pension pots.

Explore the Retirement Options

Planning for retirement

Whether you are about to take your Defined Contribution (DC) pension pot, or your retirement is a long way off, it’s worth understanding more about your benefit options.

Annuity

An annuity provides a secure, regular income for life that you buy from an insurance company.

All Cash

Take all your DC pension pot as one or two cash lump sums (split between two tax years) from the Scheme.